Your part of the supply chain faces a market place that is full of changes. Changes brought by Economic down-sizing, demographic profiles and a huge growth of new items.

If you have not taken a close look at your orders, you are incurring avoidable distribution costs due to incorrect layout, in correct picking methods and incorrect slotting. It is like driving a car that is badly tuned. Don’t throw it away, fix it. You can do the same for your warehouse.

You may have the same SKU’s in several distribution centers. But what the customer buys and how the customer buys will be different in different DC’s.

Here are some important topics to consider

- · Who is your customer?

- Are there different types or groups of customers buying products from your facility?

- · How does the customer place the order? We are referring to the size of the order?

- We usually call this ‘Lines per Order”

· There are so many other issues involved but these are the most important right now.

1.0 Lines per order – how do you calculate this?

At Karma Logistics, the client company is asked to share 4 individual sets of 1-week worth of data. This is the ‘order-pick’ level data.

It is simply – on a certain date, by unique invoice, which customer ordered how many lines of orders.

Unless strong seasonality is involved, we never ask for 1 year’s worth or last year’s data.

The same weekly picking data is later used to simulate actual order picking.

We have inserted below a recent order-pick file.

The first customer, shown in blue, has ordered 9 lines and 11 pieces.

If the same customer had placed 2 different orders in the same day, we should not combine them. We should keep them separate, since, we picked them separately, perhaps one in the morning and one in the afternoon.

2.0 Graph – Lines per Order chart

Then we prepare a cumulative percentile graph. Like the one above. Often it resembles the common ABC graph. From the data behind this graph, we conclude that about 80% of the orders contain 7 or less number of Lines per order. We use this number 7 in the discussion below.

3.0 How do we slot the products based on the Lines Per Order.

In the chart above, we show the Lines-per-order (LPO) in the range of 1 to 45.

3.1 Lines-per-order equals 1 or 2

Such orders are most common in the TV-based selling like in Home Shopping Network and others. In a matter of 20 minutes, you may get as many as 6000 orders. The best way to slot and pick these items is called ‘consolidated pick’. We try to pick the entire 6000 or smaller bunches of this order in bulk, bring them to the packaging station, apply shipping labels to those 6000 orders all asking for the same sku. The corresponding slots for such products may consist of both bulk slots and some small shelving also. Since this particular item is on the catalog, customers may order this item later on also, after the TV promotion is over.

3.2 Lines-per-order is 3 to 6

Many non-food, general merchandise, electrical, parts DC, usually have LPO in this range. We recommend ‘velocity based layout’ for these types of orders. Yes, velocity based, but use some staggering technique to avoid congestion.

3.3 Lines-per-order is 7 to 15

This is the grey area between velocity slotting and family based slotting. If an end-customer receives a shipment of 15 sku’s, how difficult it may be for the customer to sort the items, check against the packing slip and authorize the invoice for payment. If the items are generally in the same product sector, you can go with velocity slotting. But if the products represent a wide range of families and sizes, family slotting may be better. But this is a toss-up.

3.4 Lines-per-order is 16 and higher.

If you promise good customer service from your warehouse, you must slot based only on Family. Grocery warehouses often have 200 lines per order or more.

4.0 Does your warehouse ship to different Customer Types?

For example, Churches and restaurants order differently. Wal-Mart orders in a different pattern from an ordinary drugstore chain.

If your customer types vary, you should consider looking at the SKU’s that each customer-type orders. . Consider groups of customers rather than individual accounts.

Do they, by chance order unique sku’ on part of their order?

|

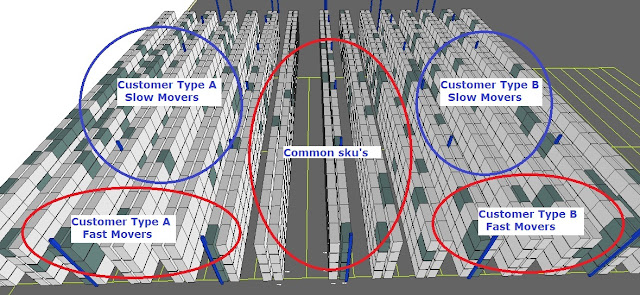

| Warehouse3DView - a Proprietary Karma Logistics software tool |

In the 3D-drawing above, we show some ideas to take advantage of identifying the customer-types in your business and slotting the products accordingly. When you are picking SKU’s unique to Customer Type A, you should not be forced to walk across sku’s belong to Customer Type B.

If these customer-types share many common sku’s, slot them in a separate zone.

5.0 Profiling your DC – the “Karma” way

The chart below attempts to illustrate the long list of variables that will determine your BEST CASE combination of “Layout Design – Product Slotting – Picking Methodology”

6.0 So far the ‘theory”. How do you make it happen?

We hope that your DC is in such fine shape that none of the 8 symptoms shown in the graphic below occur in your DC.

We have never walked into a DC that works just like the principles that we propose in PowerPoint presentations. Reality is a different animal.

The warehouse is usually at 120% of capacity; the trucks unloaded during the day shift are either in the dock or located in the middle of the aisle. We expect Forklift operators to do miracles. And they do. They will put more 2 different sku’s in the slot and hope the night shift Order-picker will understand.

And the list goes on. See the graphic.

7.0 Reality – Do lots of house cleaning. Get rid of junk. Get some ‘breathing space’

8.0 “Tune” your process

9.0 The picture below is worth a thousand reports

Using the same Order-Pick data that we used to compute Lines-per-Order, we compute the HITS for each slot. We define Hits as the number of times you visit a slot. We don’t look at how many ‘pieces’ were picked at a slot.

10.0 Don’t let your warehouse start ‘rotting’ again.

Having taken the time to ‘tune-up’ your warehouse, we ask you to keep it at top running conditions. This is where we provide an automatic weekly tune-up service. With your permission, we connect to your database, once every week, analyze the slotting group criteria established, look for items that are no longer slotted right and we tell you where to ‘move’ them. Plus, we will only tell you those items to move, that will return the best value for you. We do this by doing a ‘before-and-after’ simulation and computing our unique ‘penalty costs’

11.0 We do all this for just 1 reason; To cut down the travel time.

If you want us to fine-tune your facility, you can contact us at the address below.

12.0 You-Tube video that describes our unique way to tune-up your warehouse

Click on the Black arrow in the middle

Turn the sound ON in your PC

Contact:

ram.krishnan@karma-logistics-inc.com Senior Consultant at Karma Logistics Inc

Linkedin Bio at: